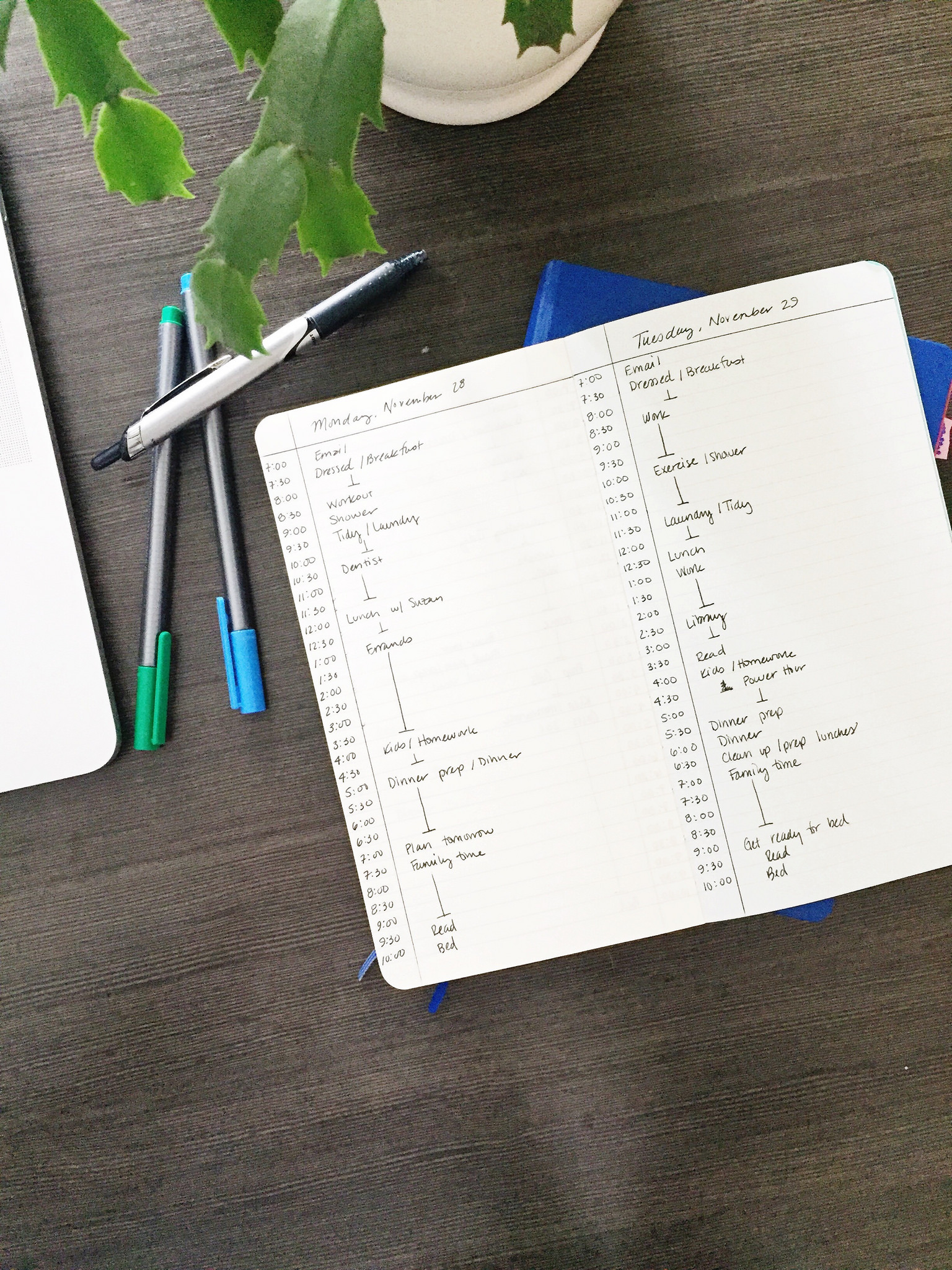

2016 was the year when it seemed that my productivity goals all seemed to fall into place. I'm an odd mix of a productivity junkie (anything with the keywords "be more productive" or "get things done" is like click-bait to me) and a dreamer. Sometimes I dream about big things, … [Read more...] about You Have More Time Than You Think: How a Time Study Brought Balance Into My Life

home

8 Habits To Keep Your Home Organized

It probably comes as no surprise to any of you that I'm fairly organized. I work for the The Container Store (The Original Storage and Organization Store), after all. A clean home with some empty spaces is what feeds my soul and keeps me sane. You may think that I spend hours … [Read more...] about 8 Habits To Keep Your Home Organized

3 Keys to Managing Family Finances Without Fighting

Thank you to TurboTax for sponsoring my writing about household finances. Learn more about how TurboTax can help you find every tax deduction you deserve. I was selected for this sponsorship by the Clever Girls Collective, which endorses Blog With Integrity, as I do. Who … [Read more...] about 3 Keys to Managing Family Finances Without Fighting